More Prompts:

Best prompts for LIM for summarization using financial reports

12 practical, copy-ready prompts designed for LIM/LLM use to summarize financial reports (10-K/10-Q, earnings releases, annual reports, MD&A, cash flow statements, etc.). Each prompt includes a concise explanation, a realistic example input, and recommended AIs that perform best with the task.

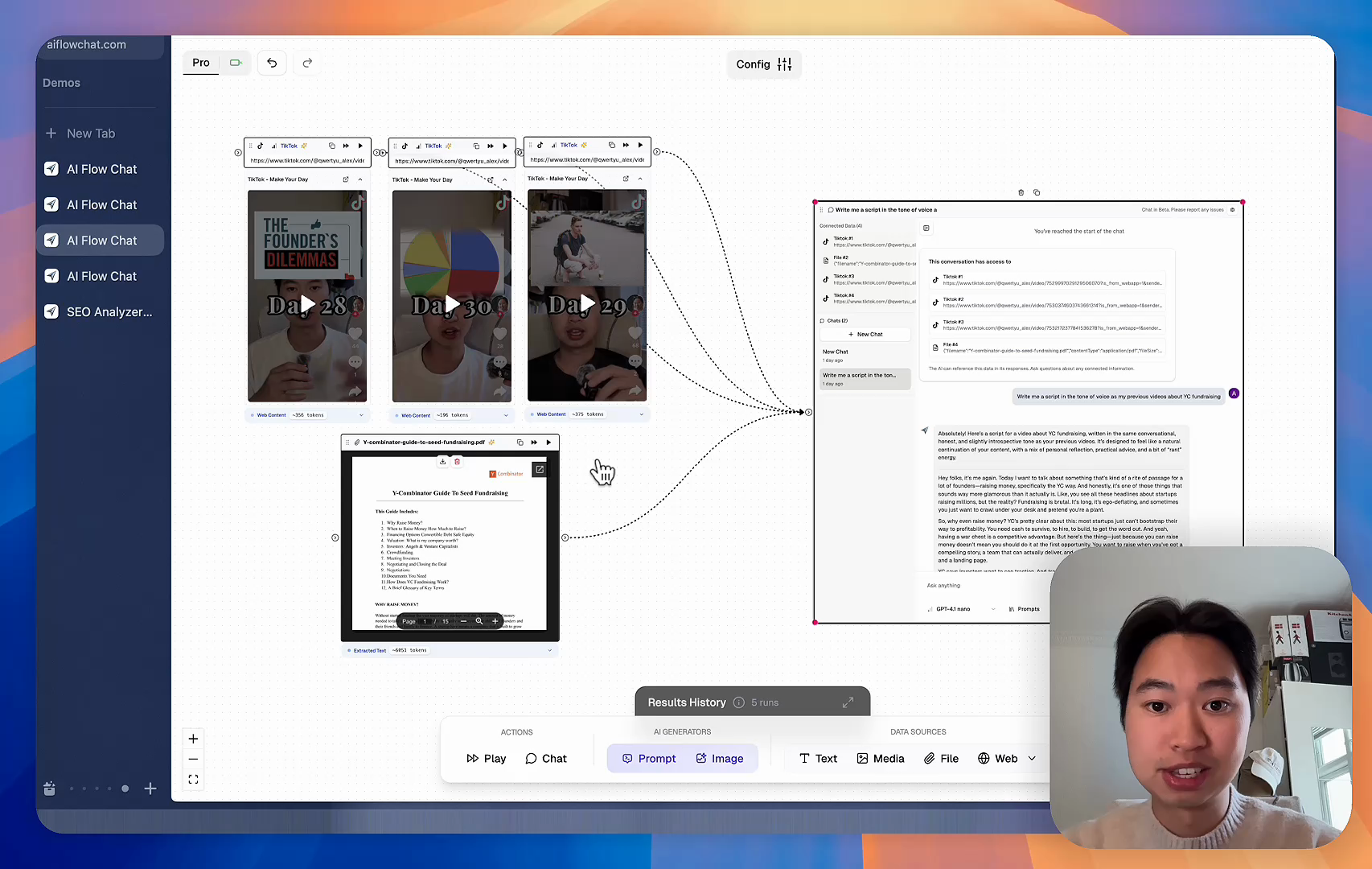

Stop Losing Your AI Work

Tired of rewriting the same prompts, juggling ChatGPT and Claude in multiple tabs, and watching your best AI conversations disappear forever?

AI Flow Chat lets you save winning prompts to a reusable library, test all models in one workspace, and convert great chats into automated workflows that scale.

“AI Flow Chat powers our entire content strategy. We double down on what’s working, extract viral elements, and create stuff fast.”

Reference Anything

Bring anything into context of AI and build content in seconds

YouTube

DOCX

TikTok

Web

Reels

Video Files

Twitter Videos

Facebook/Meta Ads

Tweets

Audio Files

Choose a plan to match your needs

Upgrade or cancel subscriptions anytime. All prices are in USD.

For normal daily use. Ideal for getting into AI automation and ideation.

- See what Basic gets you

- 11,000 credits per month

- Access to all AI models

- 5 app schedules

- Free optional onboarding call

- 1,000 extra credits for $6

No risk, cancel anytime.

For power users with high-volume needs.

- See what Pro gets you

- 33,000 credits per month

- Access to all AI models

- 10 app schedules

- Remove AI Flow Chat branding from embedded apps

- Free optional onboarding call

- 2,000 extra credits for $6

No risk, cancel anytime.

Frequently Asked Questions

Everything you need to know about AI Flow Chat. Still have questions? Contact us.